Your current location is:Fxscam News > Foreign News

Bitcoin heads toward $70,000, fueled by global monetary easing.

Fxscam News2025-07-23 06:36:49【Foreign News】1People have watched

IntroductionForeign exchange platform Futuo,Foreign Exchange Information Entry Website,Boosted by global loose monetary policies, Bitcoin is experiencing a new wave of growth. A recent re

Boosted by global loose monetary policies,Foreign exchange platform Futuo Bitcoin is experiencing a new wave of growth. A recent report from 10X Research predicts that, influenced by the Federal Reserve's rate cuts and China's large-scale quantitative easing policies, Bitcoin prices are likely to break through $70,000 and set new highs by the end of October.

Over the past month, the price of Bitcoin (BTC) has increased by more than 10% and is now stable above $65,000, up over 30% from the previous local low of $49,000. This strong momentum has significantly boosted market confidence, with analysts optimistic about its long-term development prospects.

Bitcoin's current market price is higher than the average realized value over the past year, indicating growing confidence among long-term investors and suggesting a more permanent uptrend.

The latest report from 10X Research further analyzes Bitcoin's market outlook. The report indicates that Bitcoin has successfully reversed its previous downward trend and is moving towards the $70,000 mark, with expectations to surpass this level within two weeks. As the end of October approaches, the market anticipates Bitcoin will reach new historical highs.

In addition to the Federal Reserve's rate cut cycle, 10X Research also emphasizes that China's loose policies will increase global liquidity, leading to a parabolic price rise in the cryptocurrency market. Previously, Bitcoin had once surged above $73,000 following events like the halving event, Trump's support, and the listing of Bitcoin ETFs. This time, it may be gearing up for another wave of growth.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(5)

Related articles

- Edward Jones FX Review: High Risk (Suspected Fraud)

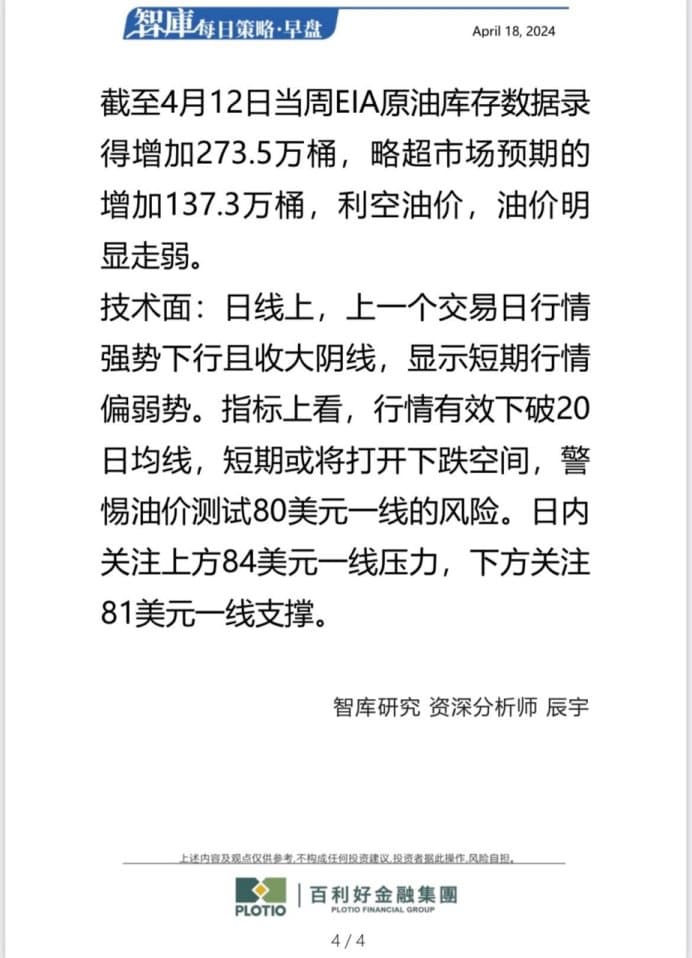

- Crude Oil Tip: Oil prices fell nearly 5% amid Libya's potential supply resolution.

- Gold strategists predict that the price of gold may rise to $2,700 by the end of the year.

- Ukraine uses British missiles on Russian targets, European gas prices hit 2024 high.

- TNFL FX Broker Review: High Risk (Suspected Fraud)

- Middle East tension eases, but lower global demand suppresses oil prices.

- U.S. elections and Middle East tensions drive oil traders to bet on $100 prices.

- Corn shorts are up, and global climate and U.S. policy shifts cloud the grain market outlook.

- MetaQuotes now supports users in querying broker regulatory information on MT4/5

- Market position fluctuations spark sentiment; corn shorts rise, soybean and wheat demand varies.

Popular Articles

- Oroku Edge Review: Is It a Safe, Regulated Platform?

- Aluminum prices stay stable but face challenges from export tax rebate cuts and tight alumina supply

- The crypto market fell sharply, with Bitcoin ETFs seeing the largest outflow in four months.

- US dollar strength and weak demand pressure oil prices; market eyes EIA data and Trump policy impact

Webmaster recommended

Market Insights: Jan 24th, 2024

Low oil prices widen Gulf budget deficits, challenging Saudi Arabia's Vision 2030.

Gold trading update: US dollar surges, gold prices stay weak. Watch Nvidia's earnings impact.

Oil price drop wipes out millions in call options as Middle East tensions ease.

Bovei Financial Limited is a Fraud: Avoid at All Costs

CBOT grain futures face pressure as capital flows and trade dynamics shape the market.

Standard Chartered reports a more optimistic outlook for global oil demand, boosting oil prices.

Oil market shows oversupply signs as prompt spread turns negative, raising supply